10 Lessons from The Psychology of Money in Visuals

A visual book summary of the best selling book on how to think about money better

A couple of years back I suddenly heard everyone recommending one book.

I wasn’t interested — I thought finance books were either all about get-rich-quick schemes or obvious financial advice that most people know but few follow.

Morgan’s book was a breath of fresh air. While it is in danger of crossing into that second group, there were both financial insights I didn’t know, the psychological reasons behind some of those factors, and broader lessons that I could apply beyond money management.

So, a few years later, here are the 10 top lessons that have stayed with me.

1. No One is Crazy

Our experiences influence our financial views (and actions) more than anything else.

If you were born during hard times, you’ll look at money differently than if you were born during good times. If your parents struggled to save cash, you might have internalised that belief about yourself too.

But our experiences are a tiny fraction of everything that has happened so it’s easy to make bad decisions.

2. Luck and Risk are Two Sides of the Same Coin

A good investment always has an element of risk/luck.

People often assume that the skill of identifying good investments and when to invest/not will be more important, but that’s not true. In reality, the skill is about managing risk in order to get lucky.

3. Everything Has a Cost

In The Office, Stanley and Michael spend a whole day waiting in line for free pretzels.

As a salesperson, Stanley would probably have been better off working those hours and paying for a pretzel where he didn’t have to queue. This applies to other financial decisions too.

They are often framed as simple binaries (spend this for that) but in reality, there are hidden costs and lost opportunities in any decision.

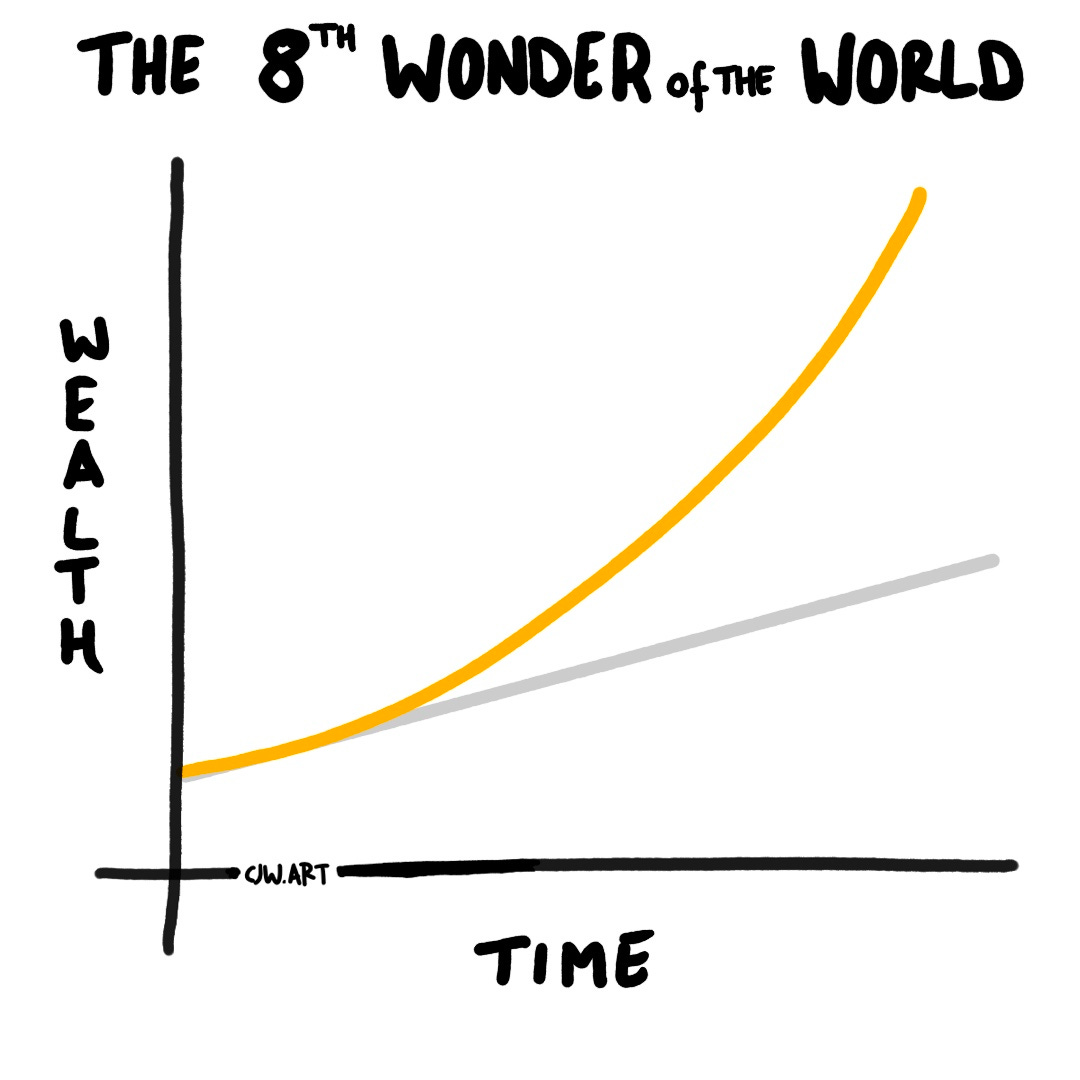

4. Compounding Interest is the 8th Wonder of the World

People are shockingly bad at predicting the returns of compounding interest.

Just try this experiment, if you passed on an illness to two people (who passed it to two more each etc) how long would it be before the entire world is infected?

32 times.

It’s difficult because compounding start small and seems to bear little fruit, but if you give it time, the results are incredible.

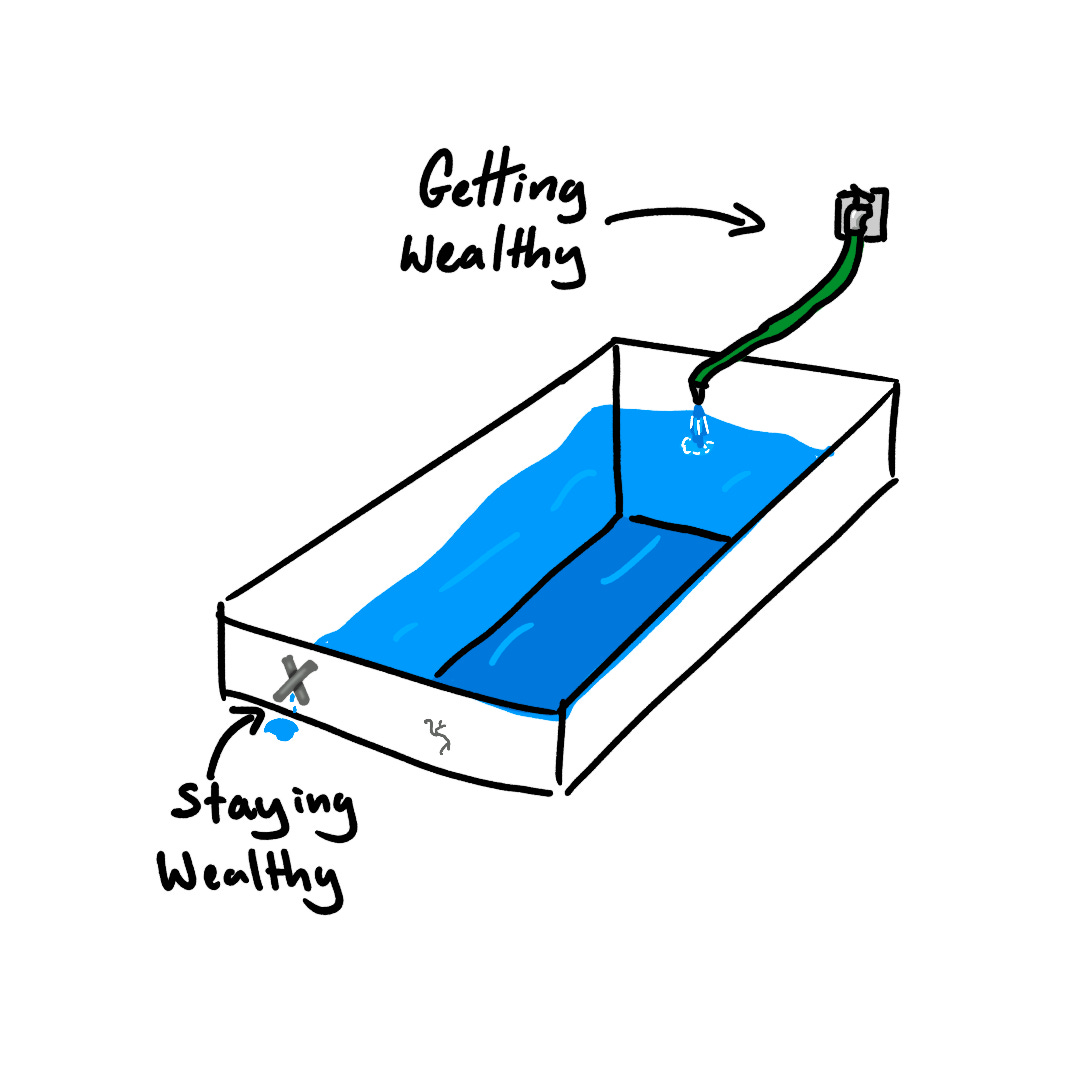

5. Getting Wealthy vs Staying Wealthy

Getting wealth is one thing, but keeping your wealth is another.

You need different skills (and different mindsets) to do so. It’s very easy to fall into the trap of increasing your spending faster than your income grows.

You need to learn to protect it.

6. The Value of the Long Tail

Most investments make a small profit or loss. But a few investments make massive profits (and losses too)!

This is the secret of VC investment firms. They are willing to lose on most of their investments with the hope that a couple will make massive profits and pay for all the rest — and more!

The application for us is to distribute our investment and savings suitably. Expect modest returns from most but use some funds for higher risk and return investments that can outperform the rest.

By the way, a key point in the book is that you should set your risk factor. Don’t go along with what others do but what you feel comfortable investing (and a more conservative investing portfolio will help you sleep easier!).

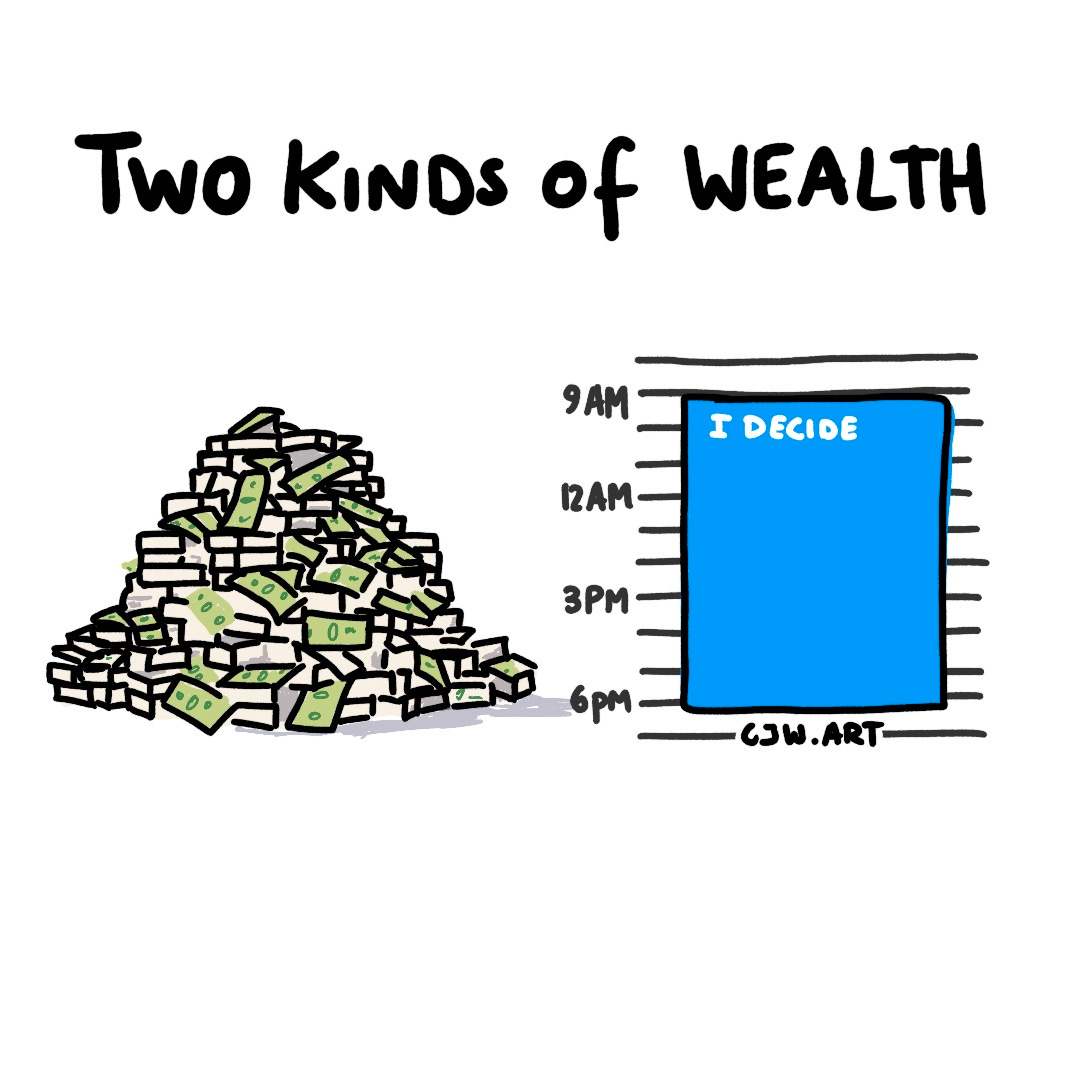

7. There are Two Kinds of Wealth

When we hear “wealth” most of us think of having money.

Morgan says

“The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.”

It’s easy for money to become a goal in and of itself, and then realise that you haven’t used that money for the things you wanted it for in the first place.

Don’t fall into the trap.

[BTW, Sahil Bloom has a new book on 5 Types of Wealth where he puts forward different types of wealth to focus on not just financial. I haven’t read it yet but you might find it interesting if this point resonated with you. And let me know if you’d like me to read it and make a summary.]

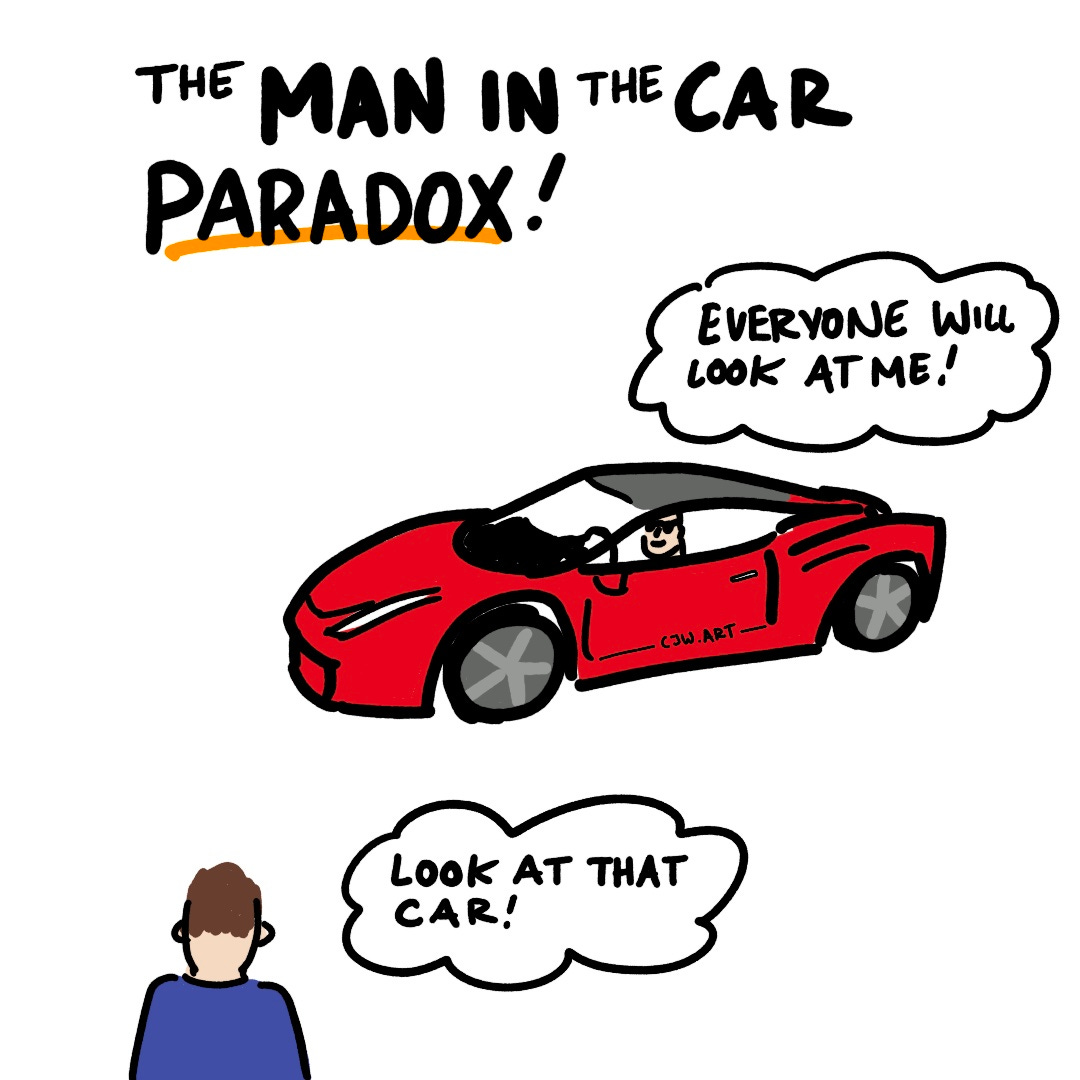

8. The Man in the Car Paradox

Buyers of sports cars assume that people will look at their car and admire them as the owner, but really they focus on the car, not the driver.

This isn’t limited to cars, many luxury purchases are to impress others rather than fulfil ourselves.

It’s better to use money for things that bring intrinsic value instead of external validation.

And if you do want external validation, altruism and kindness bestow it far more effectively.

9. Happiness is Result Minus Expectation

How many times have you been pleasantly surprised at an unexpected good result?

I’d bet it’s a good number of times, but far fewer than when you’ve had your hopes dashed by reality (Especially if you are a fan of the England football/soccer team).

This equation from Mo Gawdat suggests that what we really need is a sense of “enough”. If we can be happy living at a level of lifestyle below our income, without comparing to the standards of others, we can more often be pleasantly surprised.

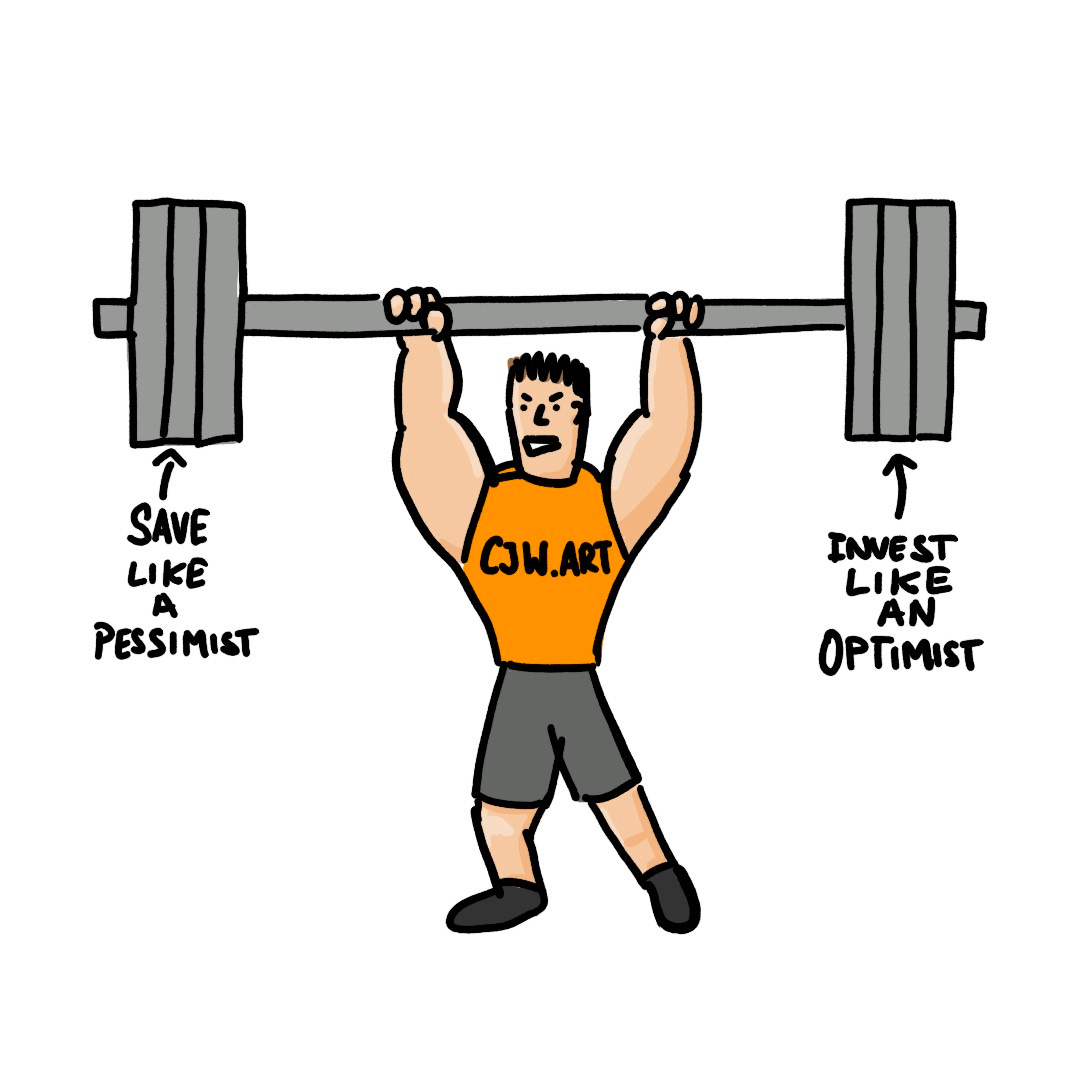

10. Save Like a Pessimist, Invest Like an Optimist

Morgan calls this a “A barbelled personality”.

Being optimistic about the future so that you can seize opportunities, but pessimistic about the things that will prevent you from getting there. It means taking care of your health so you can enjoy the future.

If you hold these two ideas in tension in your mind and actions, you’ll be able to navigate the ever-changing and uncertain financial environment (and life).

Found this useful?

If you’ve enjoyed these visuals, I’d love it if you leave a comment with which is your favourite.

And you can help others discover them by sharing them on

Thank you

Want to share ideas that matter to you? Sign up for this free email course to learn how to draw anything (sketchily) in just 5 days.

Or if you’d like me to sketch your ideas for you, check out my services.

And if you’d like another visual book summary in the future, let me know which one you want to see!

Coincidentally I bought this on Audible yesterday, it's in the 2 for 1 sale in the UK (not sure about elsewhere) so this was a good visual introduction.

I like the "look at that car" image best, I often think "nice car, shame about the driver" as some idiot speeds past me at 120mph, only in not quite so polite terms!

Thanks for the summary! My favorite drawing would be the pool, a very memorable metaphor and I always love to see how different people draw water 🙂